Investors who have low risk appetite and prefer to invest in safe instruments like fixed deposits can look at debt mutual funds to get better after tax returns. Investment in debt funds is suitable for investors who want to earn satisfactory return on their capital by taking low to moderate levels of risk. Typically, the returns will vary between – 8-12% in this category.

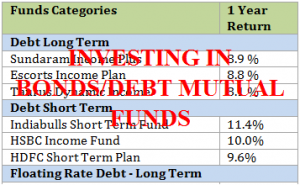

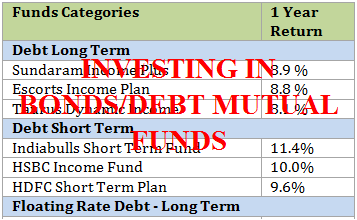

Top Performing Debt Mutual Funds in Each Category

Note: The list below is based on past performance and does not guarantee future return(s) in any way. Our view differs substantially with respect to top performing funds in future.

| Funds Categories | 1 Year Return |

| Debt Long Term | |

| Sundaram Income Plus | 8.9 % |

| Escorts Income Plan | 8.8 % |

| Taurus Dynamic Income | 8.1 % |

| Debt Short Term | |

| Indiabulls Short Term Fund | 11.4% |

| HSBC Income Fund | 10.0% |

| HDFC Short Term Plan | 9.6% |

| Floating Rate Debt – Long Term | |

| JM Floater LTF – Premium | 9.0% |

| Franklin (I) Savings Plus | 8.8% |

| HDFC Floating Rate Inc. – LTP | 8.4% |

| Floating Rate Debt – Short Term | |

| Escorts Short Term Debt Fund | 9.0% |

| SBI Savings Fund | 8.8% |

| L&T Floating Rate Fund | 8.7% |

| Ultra Short Term Debt | |

| Franklin India Ultra-Short Bond Fund | 9.7% |

| HDFC Banking & PSU Debt | 9.6% |

| DWS Low Duration Fund | 9.4% |

| Gilt Long Term | |

| Motilal MOSt 10 Yr Gilt | 10.9% |

| Sahara Gilt Fund | 7.4% |

| Escorts Gilt Fund | 7.1% |

| Gilt Short Term | |

| HDFC Gilt Fund – STP | 8.8% |

| SBI Magnum Gilt – STP | 8.6% |

| IDFC G-Sec -Short Term | 8.2% |

| Liquid Schemes | |

| JM High Liquidity – Inst | 9.0% |

| L&T Liquid – Inst Plus | 8.7% |

| Principal Money Manager-Direct | 8.7% |

Types of Bonds/ Debt Mutual Funds

Debt funds can be classified on the basis of:

(i) tenor of the securities: short term / long term; and

(ii) type of issuer: government/ corporate/ PSUs and others.

ON THE BASIS OF TENOR

Thumb Rule: Shorter the duration to maturity, lower the return.

At the same time, shorter duration investments do not have a high interest rate (fluctuation) risk as is the case with longer term maturity instruments.

- Liquid schemes – these schemes invest only in short term debt securities of up to 91 days maturity. These schemes carry lowest price risk among all kinds of mutual fund schemes and are ideal for investors seeking high liquidity with safety of capital.

- Short term debt schemes – invest in securities with short tenors (1-2 years) that have low interest rate risk. Ultra-short term debt funds, short-term debt funds, short-term gilt funds are some of the funds in this category.

- Ultra short-term plans – invest in money market and other short term securities of maturity up to 365 days. The objective is to generate a steady return, mostly coming from accrual of interest income, with minimal NAV volatility.

- Long-term debt schemes such as Gilt funds invest in longer-term securities (3 year +) issued by the government and other corporate issuers.

On the basis of Issuer

- Government funds/Gilt funds invest in only treasury bills and government securities. There is no risk of default since securities here are backed by the government. Liquidity is considerably high in case of government securities. However, prices of long-term government securities are sensitive to interest rate changes, i.e. when RBI cuts interest rates, the overall interest yield on these securities will fall and vice versa.

- Corporate bond funds invest in debt securities issued by companies, including PSUs. There is a high credit risk associated in this category which is denoted by the credit rating assigned to such security. Such bonds pay a higher coupon income to compensate for the credit risk associated with them.

Tax Implications

Securities Transaction Tax

STT is not applicable on transactions in debt mutual fund (including liquid fund) units.

Capital Gains Tax

Capital Gain is the difference between sale price and acquisition cost of the investment.

- Short Term Capital Gains – investment is held for 3 years or less.

- Capital gain is added to the income of the investor and gets taxed at the marginal rate of taxation as per the tax slabs applicable for the investor.

- Long Term Capital Gains – investment is held for more than 3 years.

- Investor is entitled to the benefit of indexation. Capital gains (post-indexation*) are taxed @20% plus applicable surcharge and 3% cess.

*Indexation means that the cost of acquisition adjusted upwards to reflect the impact of inflation. Schedule to calculate indexed price based on the cost price of bond fund is published by the Income Tax Authority each year.

Dividend Distribution Tax

Unlike equity mutual fund schemes, dividend distributed by debt mutual fund schemes is taxable as follow:

| Residential Individuals and HUF | 25% + 12% Surcharge + 3% Cess |

| NRIs | 25% + 12% Surcharge + 3% Cess |

| Domestic Companies | 30% + 12% Surcharge + 3% Cess |

#Investors can avoid ‘Dividend Distribution Tax’ by opting for the growth option of a debt scheme.

Debt mutual funds come in all sorts of varieties. Investors can approach us or their Investment Advisor to choose a fund that works best as per their risk appetite, goals and return expectations.

Email: rajat@sanasecurities.com

________________________

INVESTMENT STRATEGY ADOPTED BY BONDS/ DEBT FUNDS

Diversified debt funds – invest in a mix of government and non-government debt securities such as corporate bonds, debentures and commercial paper. The corporate bonds earn higher coupon income on account of the high credit risks associated with them and government securities are held to meet liquidity needs.

Junk bond schemes or high yield bond schemes invest in securities that have a lower credit rating indicating poor credit quality and high rate of return.

Dynamic debt funds are flexible in terms of the type of debt securities held and their tenors. They do not focus on long or short term securities or any particular category of issuer but look for opportunities to earn income and capital gains across segments of the debt market. If the fund manager believes that interest rates could move up, the duration of the portfolio is reduced and vice versa.

Fixed Maturity Plans (FMPs) are a kind of debt fund where the investment portfolio is closely aligned to the maturity of the scheme. Typically, fund houses keep rolling out structured FMPs as and when their corporate clients have need to park their money for a fixed duration.

Floating rate funds invest largely in floating rate debt securities i.e. debt securities where the interest rate payable changes in line with the market.