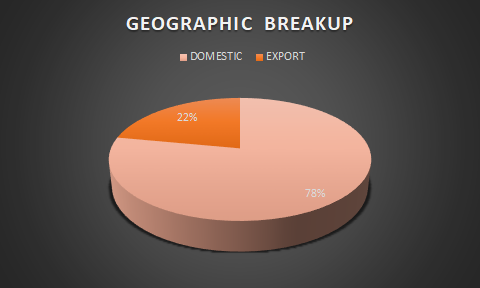

Deepak Nitrite Limited is one of India’s fastest growing and trusted chemical intermediates company with a diversified portfolio that caters to multiple industries with numerous applications. These products are widely used across end-user industries such as pharma, agrochemicals, plywood, paints, etc, and serve as building blocks /key raw materials for further processing into various other specialty chemicals or end-user industries.

KEY PERFORMANCE INDICATORS

Despite having a diversified portfolio, Deepak Nitrite is down 25% from its all-time high.

Deepak Nitrite, a darling stock among investors, has surged almost seven times, from 400 to nearly 2900 from January 2020 to October 2021. However, it has experienced a 25% correction from its all-time high.

WHAT FORCES ARE DRIVING THE STOCK PRICE

On the back of its strong R&D capabilities, Deepak Nitrite is transitioning from a bulk chemical-focused entity to a high-margin chemical intermediates-focused Company. However, the majority of Deepak Nitrite’s products are still commoditized and are highly cyclical.

To put things into perspective, we must understand the business model and the value chain of Deepak Nitrite.

ABOUT DEEPAK NITRITE

Deepak Nitrite was incorporated by C.K Mehta in 1970. The company opened its first Sodium Nitrite manufacturing plant in Nandesari, Gujrat. During the period spanning from 1997 to 2008, the company encountered significant challenges in achieving profitability and surpassing the cost of capital mainly due to competition from China’s large-scale manufacturing plants and Deepak’s inability to pass on the raw material volatility.

However, In 2009, the closure of Chinese chemical companies redirected the supply chain to India, positioning Deepak Nitrite as the primary beneficiary of this strategic shift.- Deepak Nitrite became the largest producer of Sodium Nitrate and Sodium Nitrite with over 70% market share in India (Highly commoditized product)

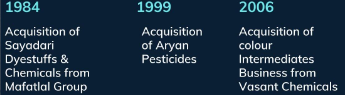

To move up the value chain Deepak Nitrite has made 3 acquisitions which provided Deepak Nitrite the necessary impetus.

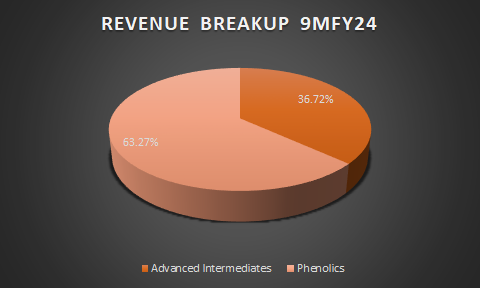

Deepak Nitrite currently reports its revenue under two segments-

- Advanced Intermediates – The Advanced Intermediates are further classified into

-

-

-

-

-

- Basic Intermediates (Highly commoditized and highly dependent on crude oil) – Standard products such as Sodium Nitrite, Sodium Nitrate, Fuel Additives, etc are manufactured in bulk. EBITDA MARGINS – 16%- 18% End-use Applications – Colourants, Petrochemicals, Rubber, Agrochemicals, Pharmaceuticals, Glass Industries, Industrial Explosives and Fuel Additives.

- Fine & Speciality Chemicals (Low volume & High margin) – Specialised products customized to the client’s specifications Product Portfolio – Xylidines, Oximes, Cumidines, Speciality Agrochemicals End-use Applications – Agrochemicals, Colours & Pigments, Paper, Personal Care, Pharmaceuticals etc.

- Performance Products (Highly commoditized) – Deepak Nitrite is a fully integrated player in this segment across the world. –> EBITDA MARGINS- 18% – 20% Product Portfolio – DASDA & Optical Brightening Agents (OBA) End-use Applications – Hidden chemicals present in detergent that make clothes appear cleaner, brighter, and whiter. OBA is also used by paper manufacturers (for manufacturing writing and printing papers), especially high-brightness papers, also extensively used by the textile industry. DASDA (Diamino Stilbene Disulphonic Acid) – Key compound used in making OBA.

-

-

-

-

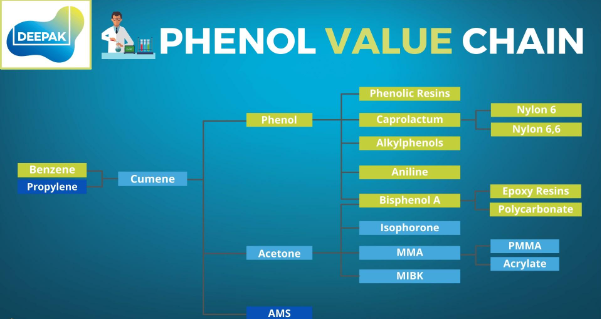

2. Phenolics – Deepak Nitrite capitalized on an early high domestic demand for Phenol & Acetone and gradually emerged as a dominant market leader, holding a 56% share. —> EBITDA MARGINS – 12% to 15%

On an overall basis, management expects EBITDA MARGINS TO BE 16% to 18%

Phenol is used in the manufacturing of a large range of commercial products. It is consumed in laminates, automobiles, foundry, paints, rubber, surfactants, pharma, agrochemicals, etc.

PHENOLICS IS HIGHLY COMMODITIZED AND CYCLICAL

To address the issue of the cyclicality and fluctuations in raw material costs related to Benzene and Propylene, the management has announced a new greenfield expansion project that focuses on Phenol Acetone. The company aims to become a fully integrated entity in the market, which involves pursuing both backward and forward integration strategies. The objective is to increase operational resilience and have better control over the supply chain

There will be Bisphenol A which will be a downstream of phenol and acetone as well as an upstream of polycarbonate resin.

Acetone: Acetone is used in the production of pharmaceuticals, paints, adhesives thinners, etc. It is used in industries such as the pharma industry, paints and adhesives, and other key sectors including Aldol chemicals, Methyl Methacrylate (MMA), etc

Reasons for getting into Phenol & Acetone:

- Import substitution opportunity

- The domestic capacity of acetone stood at 48,000 MTPA which was incapable of meeting the rising demand

- Likewise, Indian acetone production stood at ~30,000 MT, whereas close to 1,40,000 MT was imported.

Capacity Utilization is close to 85% in Deepak Phenolics

- Deepak Nitrite Ltd- Manufacturing Plants

-

Nandesari, Gujarat: Basic chemicals, eg Para Nitro Toluene(PNT), Nitrotoluene

- Taloja, Maharashtra: Hydrogenation & noble metal catalysis specialty

- Dahej, Gujarat: Phenol-Acetone, OBA

- Roha, Maharashtra: Fine & Specialty chemicals

- Hyderabad, Telangana: Manufactures Optical Brightening (OBA) Intermediates (DASDA)

Deepak Nitrite is taking a giant leap towards becoming a fully integrated player in chemical space management with significant capital expenditure.

Deepak Chem Tech Limited signed ~Rs. 9,000 crore MoU with the Government of Gujarat to establish projects in the State of Gujarat, to manufacture 3 new products

Now to answer WHY DEEPAK NITRITE IS DOWN BY 25%

Deepak Nitrite has been experiencing margin crunching and supply-side constraints related to its key raw materials. As a result, the company’s margins have shrunk. Also, it’s important to note that Deepak Nitrite’s products are mostly cyclical and commoditized. However, the management team has a track record of identifying such blockages and providing the necessary impetus. They do not shy away from taking big and bold bets, like the Phenol capex. Therefore, by signing a Rs. 9,000 crore MoU with the Government of Gujarat Deepak Nitrite is aiming to become a fully integrated player across all segments where low demand and margin compression in one segment can be compensated by high demand in another segment.

In the short run we can expect certain price correction in Deepak Nitrite however with such capex guidance and top-notch management we believe that management has the capability to grow its wallet share and double its revenue in the next 2-3 years

An investor would appreciate that Deepak Nitrite Ltd has preferred to create multipurpose manufacturing plants where it can switch production from one chemical to another as per the changing market scenario. Due to this flexibility, the company has been able to improve its product mix over the years to focus more on high-margin products. This is one of the most important factors leading to a significant improvement in the profit margins of the company.

Management Commentary-

- “The Phenol and Acetone business will bring in a new platform for growth. Phenol serves as a major building block for the infrastructure industry including housing, roads, and construction as well as for windmills, automobiles, etc. Initially, these chemicals would be filling the import gap as bulk commodities, in the long run, they will support specialties for markets such as perfumeries, plastic additions, and decorative laminates. A major contribution from the phenol segment would be in offering a range of solvents for the pharma industry, thus strengthening its relationship with pharma industries in India”.

- Initiatives around debottlenecking of Phenol facility has commenced and the same is expected to increase the production byclose to 10% over FY 23 levels, thereby giving DPL more headroom for incremental growth in phenol

- DCTL to invest around Rs. 5,000 crore across these projects with aim to commence the first phase in 2024-2025 and aims to complete these projects by 2026-2027 and aims to generate a revenue of approximately 1.5 times the investment