A few days back somebody asked me why I do not disclose the portfolio of stocks I am holding. He went on to ask me if I have sold Maruti Suzuki, a stock I had never ever purchased. He showed me an article where I was quoted as saying “ …. It makes a good buy at current price…”. I guess he went ahead and bought it.

Until a few years back, I used to regularly write and tweet about all the stocks I bought and sold, and the stocks that I had a view on, irrespective of whether I bought them or I did not. It is fairly easy to market yourself by recommending a buy or sell on a stock all the time. Twitter is filled with analysts who pick up the latest development for a stock ranging from a management change to quarterly result and give a view on it – good, great, bad, poor or just about OK.

The ones who do not disclose what they are holding/ recommending, will be mature enough to fall in either of the two categories below:

(1) Will either have real clients invested in their recommendations; or

(2) Realize what a dis-service they will be doing to their own business, if not to the investor who follows them.

First of the above points is rather clear, if my clients are paying me for a service, how can I charge them and extend the same service for free to someone else? Once I reached a point where my real clients started reading my articles and tweets closely, it became important for me to be more careful about what I say in public domain. After all they should know everything before anyone else.

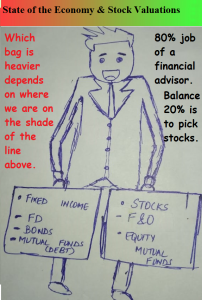

Now the second point, and this is more important. Over the years I have noticed that investors lose money not so much by investing in bad stocks, but more by committing too much to stocks. I can give you a list of 10 stocks that I like. These are great businesses; any good advisor or veteran will testify to this. The art and science is not identifying these stocks. The real art is to know how much to commit to these based on fundamentals.

Between 2017- 2020, markets remained overvalued pretty much all the time. Yet money kept getting committed to stocks. Today all those gains are gone. Regular investments made in fixed deposits these last 2 years would have yielded better (much better) returns, besides giving you an amazing ability to buy stocks now. Investors lacked patience and were convinced that long term investing in any market is great, perhaps greatest thing ever discovered.

Look at this image below, it will sum things up beautifully.

I am also fascinated by the approach of recommending 1 (or even 20 stocks) to a group of people, all of whom have different amounts of money in the bank, are at different stages of their life, have varying goals and responsibilities for future. Suggesting 5 small or micro caps and 5 large caps to such diverse group of audience, for what? And for what in return? At best a large group of disillusioned believers who may or may not be attentive. At worst, unnecessary criticism for no reward or remuneration in return.

Do tell me if you see a merit in disclosing your positions in the comments section below.

Pls advice reg franklin debt funds niw that a stay order is placed on e-voting & rights of the investor. Pls follow up with this issue on regular basis..We need your advice.