Over the last few months, I have received far too many mails expressing views on value investing and stocks that are undervalued, often deeply undervalued in the opinion of the writers.

One of the best comments I received came from a 65 year old lady, who wrote this:

I have done a little research of my own and found that these days most of the shares are not only fully valued but a good many of them over-valued.

I agree 100%.

In fact, I go further, if you find a stock that is not fully valued (or overvalued); think 100 times before attributing any value to it, let alone stamping it as ‘Undervalued’. Most likely there is a problem with the business. While the world of value investing bloggers will turn against me, let me assure the readers that the only purpose which principles of value investing serve these days is to help bloggers fool a large mass of retail investors.

It is easy to convince about the idea of value given that historically many investors became famous following the value approach.

Let me take the 2 most basic principles of value investing

- First, Stocks Being Undervalued, and;

- Second, Margin of Safety

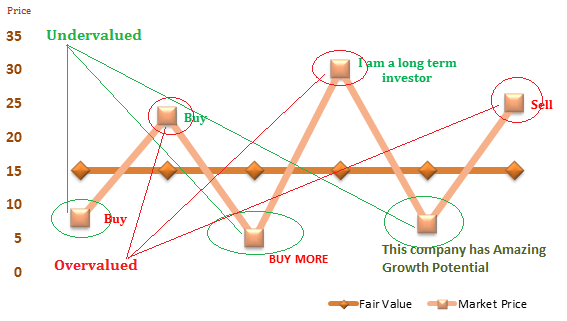

Sure. Stocks are and have always been undervalued and overvalued at different times. Again . . . what exactly do these words mean?

Undervalued in relation to what? The price?

Ok so the value is higher (or far higher) in relation to the price. Now – ‘you know the price but not the value’, as they say.

Let’s play AMAZE – A game about arriving at a (pre-set) value figure, mathematically!

Here is an explanatory chat with Mr valuation for the year 2015:

| Question | Mr valuation |

| How exactly will you arrive at the value? | Oh, I will do the whole PE / DCF / PV etc. etc. model, multiply numbers with a potential growth factor and BAMM! I will give you Rs. 440, on an excel baby! |

| Aren’t these PE / DCF / PV exactly what everyone else out there is doing? Why are they arriving at different values? | Ahh. Because they are using different growth factors. None other than me are correct though unless of course they managed to arrive at the same result. |

| But growth factor is always an assumption – so it really is that they differ in their future forecasts. | Hmmm. |

| Anyways, weren’t we talking about value? So this stock should be Rs. 440 as per you – while it is at Rs. 290 in the market. So there is value as per you because you assumed a higher growth factor than others. | No silly, I assume a growth factor based on past performance. If the company achieves similar growth in future what should then the price be in 5 years. Then I discount that price back to today’s value to see if the stock is overvalued or undervalued. Further, I check how much is it undervalued by – 10 – 20 – 30 %. I call this margin of safety. |

| Hmm. (looks up slightly towards the roof) | (Smiles and politely asks) You understand? |

| You Idiot – if all of you all are doing the same thing, what is left to be discovered other than your own assumptions of growth? | Hmm. (looks up slightly towards the roof) |

Value Investing – Keeping Everybody Busy

You or some other analyst like you has basically covered all companies using electronic calculators – given it anywhere between 10% to 50% future growth multiple – used a discount rate to discounted things back to arrive at a present value and is now convincing the world about the accuracy of his math.

This goes on 365 days a year, holidays included.

Further, let me agree with this approach as ‘The Value Approach’, (though I mark my protest against this). While I do agree that the difference between growth and value investing is fading by the day, isn’t it growth that you were really looking for with all those future multiples?

Focus On Value – But Look for What Really Matters

Trust me, you (or your money manager) are not the only geniuses who saw that a share is trading below its historic growth multiples. I did too, so did Prakash, Arjun and Mansi. Be careful . . . we did not buy it because there was something terribly wrong with the business. Forget value, in our view this business may not exist in 5 years from now.

For Warren Buffet and a host of other investors, the principles of value worked. In that era, news did not flow as smoothly as it does today, there was no internet and financial statements took a while to reach the investors. Investors and money managers had to seek time to meet corporate management and if one got lucky, he would read about a money managers interaction with an unheard of company, in some equally unheard off magazine. Those who had the courage to rely on such magazine transcripts would dwell further in their value hunt.

Things are somewhat different today. Take any company – even something that got de-listed in 2007 – search for its valuation or ‘fair value price’ on Google, let me know if not many analysts are covering it, I’ll look into it for you (get the point!).

Last Word

My idea of writing this piece was not to undermine the principles of value – if you find a big margin of safety, well done. If you feel something is trading below its historic valuations, well done again. But mostly, you should be looking for something that will trade much higher in future – not because of its historic multiples but because of how much they are likely to improve in future. IT’S CALLED GROWTH.

For all that its worth – you may do a quick math on a stock’s past and future value based on whatever pleases you – call it value and move on. It’s not a bad thing to do.

About MAGNIFICENT 7

Based on the above principles I have come up with SEVEN (7) stocks which I believe will do well over 3-5 year time horizon. To make it fancy I am going to call it – Magnificent 7.

This portfolio of stocks is available on this page – Magnificent 7 (member zone). Follow the percentage allocations for each stock for a balanced portfolio. Also note that this is not a quick rich Multibagger stock portfolio. For that you should visit the multi-bagger page of the website

Agree with you partly.

Anyway, in the current over-researched market scenario, I would like to submit that the definition of a value investor a.k.a. a long term investor should be rotated on its head.

I believe that a long term investor is someone who should be prepared to wait for a long time to invest.

He/She should wait for a black swan event (complete/partial meltdown) which will surely come once in a few years (isnt one or the other European country going to fall/default once in a while?) and invest then.

In the meantime, he/she will have enough time on their hands to research a lot of companies and pick the ones that they like when they take a battering.

Till then, maybe FD and short term debt/liquid funds are the way to go?

Absolutely agree. I hear from so many compulsive equity investors it makes me cringe.

Sure, but what about annual returns as you are sitting on the sidelines 90% of the time. Will the black swan events make up for this? Is this going to be much better than just staying in the market with a balanced portfolio and re-balancing when assets drop due to these events?

Nice article… Definitely, the times of cigarette butt investing doesn’t seem possible in the era where most of the information seem to available. However, i beg to differ as during the bull market when the crowd buys anything that they can lay their hands on, most of the value seems discovered. However, the role of value investing emerges during the uncertainty where investor mistake the uncertainty of the business environment or economy as a risk and ignore most of the value. Conversely few values still remain untraced during good times too due to underlying uncertainty in certain pockets.

Good point. So right now . . . . are we in a bull market? Is there value left to be discovered?

Hi Rajat, thank you for this post if there are nothing left to be discovered, as a prerequisite of value investing, in the internet age. Do you recommend to completely abandon value investing? What other types of investing should we replace it with?

No. I did not mean that. My view is that growth is a better metric to look for than the traditional idea of value.

I am in agreement with Basant Maheshwari-buy growth.It is costly today, it will be more costly to marrow.

Anyway its more good article for value investing.