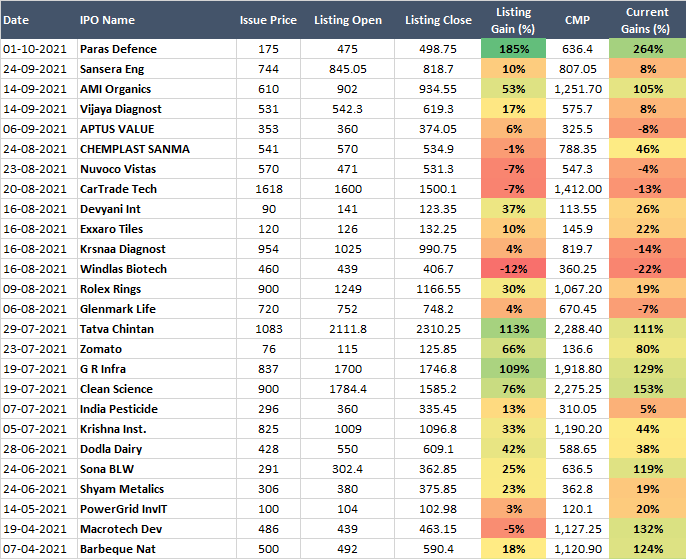

The primary market has been in strong action since the beginning of this year. The IPO momentum has been strong this year. More than 40 companies have raised record amounts via their initial public offerings thus far. The Companies have raised Rs. 84778.16 Cr. as against the cumulative issue size of Rs. 71908.55 Cr. The average listing gain has been about 30%, with only 10 issues being listed at a discount and nine issues delivered more than 50% listing gain.

The market is positive that the upcoming IPOs will continue with past momentum, as the secondary market indices are trading at their highest level. Retail participation is also increasing and many new investors are flocking to reap the listing gains. New-age business like Zomato has also attracted investors towards the primary market.

IPO Performance of Companies (Since June) – 2021

We believe that the primary market will continue to be active as large number of companies with high pedigree businesses are looking to get listed. Investor’s appetite is also high given better-than-expected listing performance in the recent IPOs. Given the strong momentum in the market, promoters are finding this as an ideal time to cash in the market. Despite concerns of a third Covid-19 wave and expensive valuations, the market has shown appetite for IPOs. The companies have seized the opportunity and find this an appropriate time to dilute their stake and raised money.

List of Upcoming IPOs

There is a long list of upcoming ipos if you go by the number of companies that have filed a DRHP with SEBI. In fact, the remainder of 2021 is set to witness record fund raising through IPOs. For the next 6 months, we have a huge pipeline of issues likely to hit to the market. Besides traditional businesses, a host of new-age companies including Paytm, PhonePe, MobiKwik, Grofers, PolicyBazaar, Delhivery among others that have shown their intention to list this year and have approached the capital markets regulator (SEBI) and have filed their DRHP in preparation for IPO launch. It is encouraging to note that our markets are entering a new era with several new age tech companies preferring to list.

| IPO | Tentative Issue Size (in Rs Cr.) | Tentative Date |

| LIC | 70,000 | 2021-22 |

| Nykaa | — | 2021-22 |

| Fincare Small Finance Bank | 1,330 | 2021 |

| Bajaj Energy | 5,450 | Jul-05 |

| Studds Accessories | 450 | Feb-21 |

| Apeejay Surrendra Park Hotels | 1,000 | 2021 |

| Shyam Steel | 500 | 2021 |

| Annai Infra Developers | 200-250 | Jul-05 |

| Aditya Birla AMC | 2500 | Sep-21 |

| GoAir | 3,600 | 2021 |

| Paytm | 16,600 | October 2021 |

| Shriram Properties | 800 | 2021 |

| Aadhar Housing Finance | 7300 | Jul-05 |

| Mobikwik | 1900 | Sep-21 |

| Policybazaar | 6000 | 2021 |

| Ola | 7300 | 2022 |

| Fincare Small Finance Bank | 1330 | 2022 |

| Supriya Lifescience | 1200 | – |

| Penna Cement Industries | 1550 | – |

| Utkarsh Small Finance Bank | 1350 | – |

| Jana Small Finance Bank | – | – |

| Seven Islands Shipping | 600 | 2021 |

| ESAF SFB | 998 | Oct – Dec 2021 |

| Aarohan Financial | 1750-1800 | – |