Single most important strategic decision in investing is how to find the best equity mutual fund investments. There are different types of mutual funds available to invest in including equity, index, debt, liquid, gold and thematic funds (like infrastructure, Pharma etc) – the list is quite exhaustive.

Keep in mind that you don’t have to invest in all these funds. Different funds have different risk profile, liquidity profile and time profile. Therefore, you must first decide on the type of funds that would suit your needs.

Also Read – Best Mutual Fund Allocation

There are thousands of funds to choose from and within these funds there are the ones with high concentration on equities or debt. There are the gold funds, infrastructure funds or the oil & gas funds. Emerging company funds or funds styled as regular income (dividend) or capital growth fund.

Your fund selection could be aggressive (high risk – high reward funds) moderate (combination of various funds) or conservative (low risk funds) based on the type of investor you are. In other words, how much money will you be able to pull from other sources in case your portfolio of funds fails to deliver the desired return over the next 4 years. A good investment advisor will focus on all these aspects before coming up with an ideal portfolio.

“Disclaimer: I do not have any of these (or any other) mutual funds in my portfolio. While I regularly follow fund action i.e. buying and selling activity in various funds, I do not invest in mutual funds. It is safe to assume that at any given point my portfolio will consist of one or more stocks forming part of these schemes”.

Best Equity Mutual Funds – Composition Analysis

The analysis presented below is based on the performance and current composition of funds.

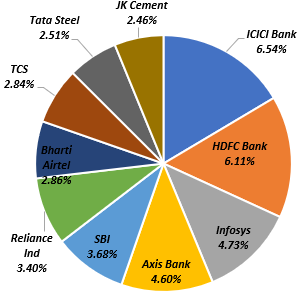

[1] Mirae Asset Emerging Bluechip Fund – Equity scheme investing in both large cap and mid cap stocks. The fund invests 35-65%+ in large cap companies & 35-65% in mid cap companies (companies not part of top 100 companies but fall within top 250 companies by market capitalization). The fund gives investors the opportunity to participate in the growth of emerging companies which have the potential to be tomorrow’s bluechip companies.

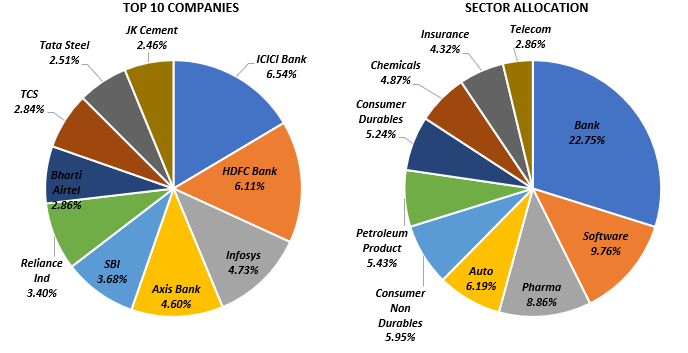

[2] DSP US Flexible Equity Fund

The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of Global Funds US Flexible Equity Fund (BGF – USFEF). The Fund invests in a portfolio of stocks of International Companies. The fund manager focuses on investing in foreign stocks, to maximise return for the investors.

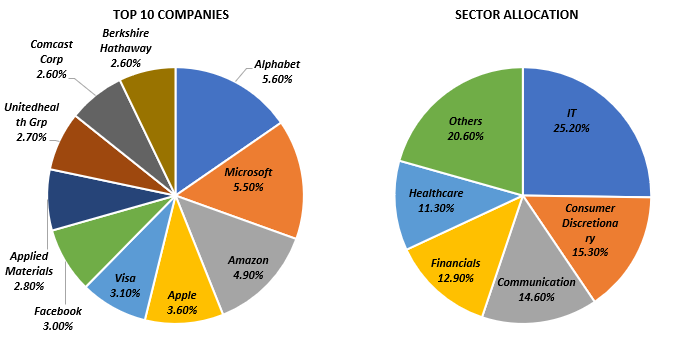

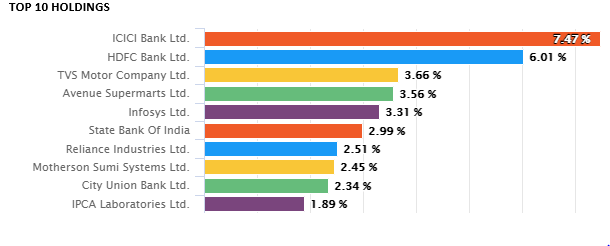

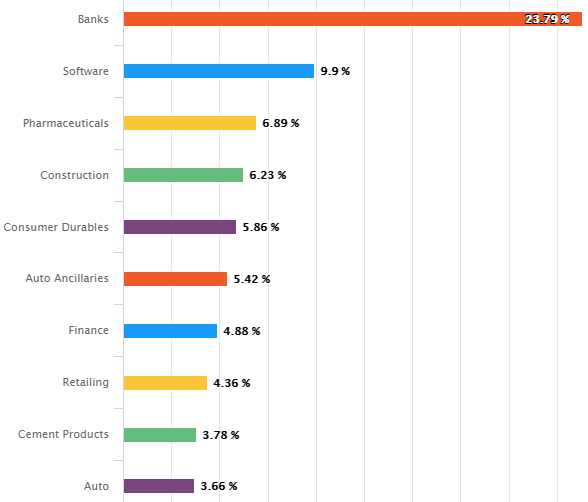

[3] ICICI Prudential Multicap Fund

The Fund aims to generate capital appreciation through investments in equity & equity related instrument across large cap, mid cap and small cap stocks of various industries.