After a steep market selloff, markets generally take time to recover, but this time market recovered quickly. It seems that the efforts of the government combined with central banks have resulted in a somewhat V-shaped recovery in the stock market. Since March 2020, the Sensex has risen over 135 % due to increase in global liquidity and a faster-than-expected earnings recovery has boosted the investor’s sentiment. The rapid increase in vaccination programs and the probability that we will not face the third wave are some of the local factors driving the market rally.

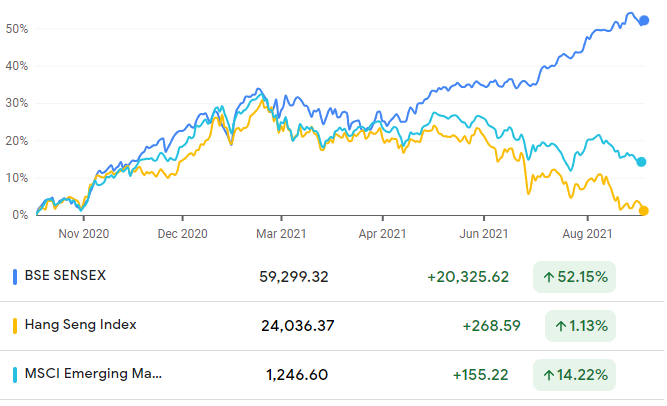

Indian markets have outperformed all other emerging markets this year. Sensex has gone up by 56.10% from 37973.22 (29th September 2020) to 59,276.78 (29th September 2021). On 24th September 2021, Sensex breached the 60,000 mark for the first time ever as the stock market continued to rally ignoring the risks and uncertainty.

Stock Market Rally | Sensex Hits 60,000 For the First Time

The outperformance of stock market has pushed valuations to very high levels. The valuation premium of Indian equities compared with emerging market counterparts has risen to a decade high. With bullish market sentiments and addition of new equities through the primary market, India’s market capitalisation increased to a record $3.50 trillion.

Since the beginning of this year, Hang Seng is down about 24% and Sensex is up about 24%. Truly globalised world!

Factors Driving the Stock Market Rally

[1] Strong Inflow By FIIs and DIIs – Robust flow of portfolio money from FIIs and DIIs are also driving the Indian Stock Market. Institutional investors continue to be one of the most significant drivers of the Indian equity market. Some of the factors that are attracting FIIs to India are anticipated strong economic recovery and earnings growth, vaccine progress, and policy stimulus measures. DIIs have been active during the second wave of Covid-19 infections.

FII & DII Trading Activity In 2021

| FII Rs Crores | DII Rs Crores | |||||

| Date | Gross Purchase | Gross Sales | Net Purchase / Sales | Gross Purchase | Gross Sales | Net Purchase / Sales |

| Sep-21 | 2,06,862.76 | 2,03,723.39 | 3,139.37 | 1,37,352.25 | 1,31,500.58 | 5,851.67 |

| Aug-21 | 1,75,168.36 | 1,77,736.88 | -2,568.52 | 1,31,185.18 | 1,24,290.49 | 6,894.69 |

| Jul-21 | 1,25,896.68 | 1,49,090.07 | -23,193.39 | 1,17,910.10 | 99,516.18 | 18,393.92 |

| Jun-21 | 1,70,188.95 | 1,70,214.84 | -25.89 | 1,14,289.67 | 1,07,246.16 | 7,043.51 |

| May-21 | 1,66,976.74 | 1,72,992.08 | -6,015.34 | 1,05,544.29 | 1,03,477.06 | 2,067.23 |

| Apr-21 | 1,33,795.77 | 1,45,835.20 | -12,039.43 | 97,884.58 | 86,524.70 | 11,359.88 |

| Mar-21 | 1,90,759.51 | 1,89,514.29 | 1,245.22 | 1,13,745.81 | 1,08,541.39 | 5,204.42 |

| Feb-21 | 2,23,030.67 | 1,80,986.21 | 42,044.46 | 1,04,175.16 | 1,20,533.26 | -16,358.10 |

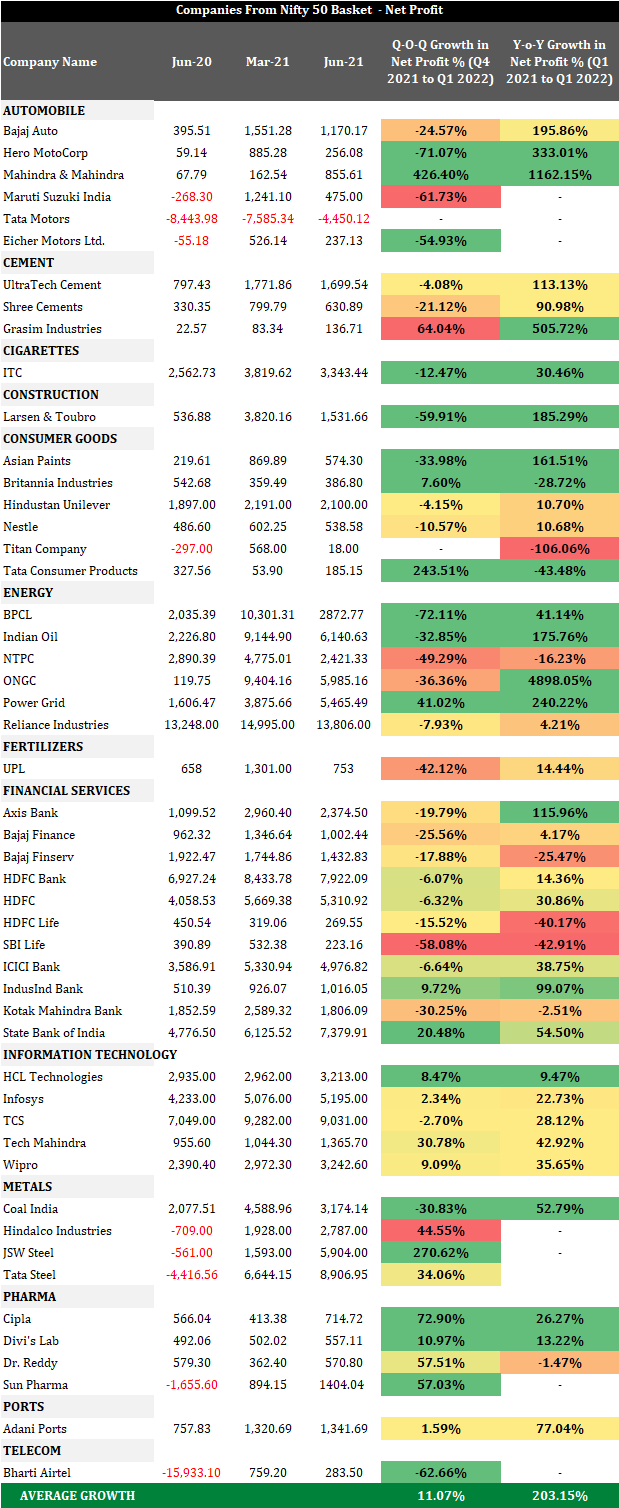

[2] Recovery in Corporate Earnings: For Q1 FY2022, earnings improved 203% (y-o-y) and 11% (q-o-q). This is the strongest corporate earnings improvement the markets have witnessed.

| AVERAGE GROWTH | 11.07% | 203.15% |

[3] Rising Retail Participation: Equity investments, whether directly or through mutual funds, have been gaining attention over the past 1.5 years. According to data released by BSE, the number of stock investors has risen by 9 million over previous quarters. As per SEBI data, the number of demat accounts has also increased to a record high at 62.2 million at the end of June 2021.

[4] Sluggishness in the developed markets after Fed minutes, July retail sales data in the US came in below expectation and China reported sub-level growth rates. These factors have also shifted investors interest to Indian stock markets.

Closing Marks – Investors must not forget that while markets are now moving upwards, but it needs only one negative news for massive correction, that will erode investor’s wealth in a jiffy. Do not underestimate the market and keep in mind that the risks around the economy including the Covid third wave. Although the pace of industrial recovery and the vaccination are rising, we should be cautious of the intensity of the third wave and how investors react to it when and if it happens.