FSN E-Commerce Ventures Limited (“Nykaa” or the “Company”) is a digitally native consumer technology platform, delivering a content-led, lifestyle retail experience to consumers. The Company has a diverse portfolio of beauty, personal care and fashion products, including its owned brand products manufactured by it.

Online: Its online channels include mobile applications, websites and mobile sites. As of August 31, 2021, the Company had cumulative downloads of 55.8 million across all its mobile applications and during the five months ended August 31, 2021, 88.2% of its online GMV came through its mobile applications.

Offline: Its offline channel comprises of 80 physical stores across 40 cities in India over three different store formats as of August 31, 2021. Its physical stores offer a select offering of products as well as a seamless experience across the physical and digital worlds.

Also Read – List of Upcoming IPO

- Nykaa Luxe: The Nykaa Luxe store format offers a luxury beauty experience. The format showcases prestige and luxury international and domestic brands. These stores are approximately 1,134 sq. ft. in size on an average and are present in grade A malls and high streets. As of August 31, 2021, it operated 38 Nykaa Luxe stores across India in cities such as Mumbai, Delhi and Kolkata.

- Nykaa On-Trend: The Nykaa On-Trend stores offer a differentiated experience for its consumers with the current best-selling products chosen across beauty and personal care brands. Along with the best-selling products, these stores also combine beauty knowledge and brands to showcase latest beauty trends and new product launches. These stores are on average 732 sq. ft. in size. As of August 31, 2021, it operated 32 Nykaa On-Trend stores across India in cities such as Coimbatore, Chennai and Jaipur.

- Nykaa Kiosks: The Nykaa Kiosks are free standing units usually in the atriums of shopping malls. it predominantly sells its owned brands through these kiosks. As of August 31, 2021, it operated nine Nykaa Kiosks stores across India in cities such as Bengaluru, Indore and Mohali.

The Company’s lifestyle portfolio spans across beauty, personal care and fashion products. Nykaa: Beauty and personal care. Nykaa Fashion: Apparel and accessories. In addition to leveraging its strengths in comprehensive merchandising, brand relationships and delivery experience, the Company focuses on educating consumers via digital content, digital communities and tech-product innovations, which is an integral component of its business model.

As of August 2021, Nykaa Fashion housed 1,434 brands and 2.8 million SKUs (stock-keeping units) with fashion products across four consumer divisions: women, men, kids and home. Beauty and personal care segment has 2,56,149 SKUs from 2,644 brands.

About the Nykaa IPO

- The price band of the offer has been set between Rs. 1085 – Rs.1125.

- The IPO consists of Fresh Issue of Equity shares aggregating upto Rs.630 Cr and Offer for Sale of upto 4,722 Cr.

Issue Snapshot:

| Issue Open | October 28, 2021 – November 1, 2021 |

| Price Band | Rs. 1085 – 1125 |

| No. of shares on offer | 13.5 Cr. Equity Shares |

| Issue Size | Rs. 5184 Cr – 5352 Cr |

| Bid size | 12 equity shares and in multiples thereof |

Object of the Issue

- The Company will utilise the net proceeds from the fresh issue to invest in two subsidiaries — FSN Brands and / or Nykaa Fashion – and for setting up new retail stores (Rs 42 Cr,).

- The Company will also utilise the proceeds for capital expenditure and investment in subsidiaries, like Nykaa E-Retail, Nykaa Fashion and FSN Brands, and for setting up warehouses (Rs 42 Cr).

- The funds will also be used for repayment of debt availed by the company and its subsidiary Nykaa E-Retail (Rs 156 Cr.), and to enhance brand awareness and visibility (Rs 234 Cr.).

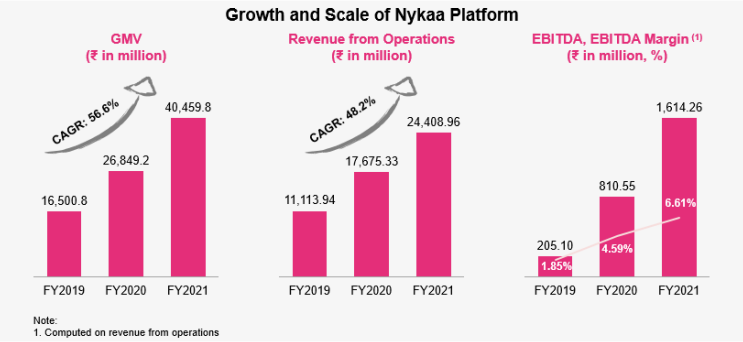

Financial Performance

| Particulars | FY 2019 | FY 2020 | FY 2021 | June 2020 | June 2021 | |||

| Revenue (In Rs. Cr.) | 1,111.39 | 1,767.53 | 2,440.90 | 288.64 | 816.99 | |||

| Growth | – | 59.04% | 38.10% | – | 183.05% | |||

| EBITDA (In Rs. Cr.) | 20.51 | 81.06 | 161.43 | -45.34 | 26.94 | |||

| EBITDA Margin | 1.85% | 4.59% | 6.61% | – | 3.30% | |||

| EBIT (In Rs. Cr.) | -10.37 | 21.55 | 94.30 | -59.92 | 7.44 | |||

| EBIT Margin | – | 1.22% | 3.86% | – | 0.91% | |||

| PBT (In Rs. Cr.) | -31.72 | -12.43 | 75.34 | -66.23 | 3.15 | |||

| PAT (In Rs. Cr.) | -24.54 | -16.34 | 61.95 | – | 3.52 | |||

| PAT Margin | – | – | 2.54% | – | 0.43% | |||

| EPS (In Rs.) | -0.59 | -0.39 | 1.34 | -1.23 | 0.07 | |||

| EPS Growth Rate | – | – | – | – | – | |||

| Historic P/E (Closing Price of 31st Mar) | – | – | – | – | – | |||

| CURRENT P/E | 839.55 | |||||||

| CURRENT EV/SALES | 21.80 | |||||||

| Shareholder funds (In Rs. Cr.) | 230.56 | 322.15 | 489.94 | 354.01 | 698.89 | |||

| Minority Interest (In Rs. Cr.) | 0.47 | 0.74 | 0.84 | 0.38 | 0.94 | |||

| Debt (In Rs. Cr.) | 225.64 | 267.55 | 187.47 | 197.83 | 268.13 | |||

| Cash (In Rs. Cr.) | 11.94 | 175.62 | 247.67 | 180.80 | 385.70 | |||

| D/E | 0.98 | 0.83 | 0.38 | 0.56 | 0.38 | |||

| Interest Coverage | (0.39) | 0.49 | 3.07 | – | – | |||

| ROCE | 4.49% | 13.73% | 23.80% | – | – | |||

| ROE | – | – | 12.64% | – | – | |||

Nykaa Investment Highlights

One of India’s Leading Lifestyle Focused Consumer Technology Platforms

The Company is the largest Specialty Beauty and Personal Care Platform in India in terms of value of products sold in FY 2021 and the five months ended August 31, 2021, and one of the fastest growing fashion platforms in India based on growth in GMV from the FY 2020 to the FY 2021 and from the five months ended August 31, 2020 to the five months ended August 31, 2021. The Company generated Rs. 4,045.98 Cr. and Rs. 1,469.61 Cr. in GMV on its platform in the FY 2021 and the three months ended June 30, 2021, respectively.

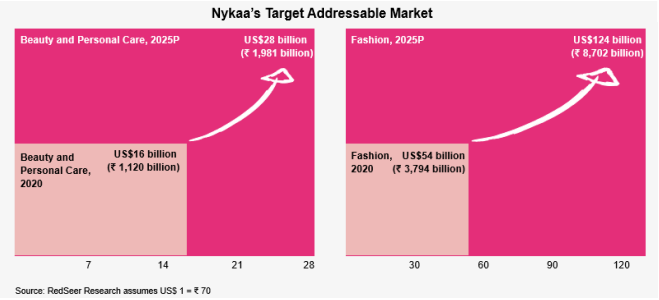

Addressable Market

India’s retail market is expected to grow from Rs 54.8 lakh Cr. in 2020 to reach approximately Rs 91.2 lakh Cr. by 2025. The Company also has a large market opportunity of Rs 10.6 lakh Cr. in the growing beauty, personal care and fashion industry by 2025 in India. The Indian beauty and personal care market is estimated to grow at approximately Rs 2 lakh Cr. by 2025 from Rs 1.1 lakh Cr. in 2020, and the Indian fashion market is expected to grow to approximately Rs 8.7 lakh Cr. by 2025 from Rs 3.8 lakh Cr. in 2020.

Strong Relationship with Brands

The Company has leading domestic and international brands in its beauty and personal care portfolio such as Clinique, Dermalogica, Dove, Estee Lauder, Faces Canada, Forest Essentials, Herbal Essences, Innisfree, Lakme, MAC, Makeup Revolution, Mamaearth, Maybelline New York, Mcaffeine, Nautica, Plum, Smashbox and Wella Professional and in fashion portfolio such as And, Bulchee, Caratlane, Fablestreet, Forever New, Gaya, House of Masaba, Hidesign, Triumph, Miss Chase, Shaurya Sanadhya, Tribe by Amrapali and Wacoal. The Company’s experience and in-depth understanding of the assortment of products, supported by consumer insights allows it to forecast trends, and tailor brand specific marketing and commercial strategies.

Diverse Portfolio of Owned Brands

The Company has a portfolio of 15 owned brands. Its owned brands play a key role in increasing the assortment of products for its consumers. Many of its owned brands have a high recall and function as independent brands. The manufacturing for such brands is carried out by third party vendors. Some of Owned Brands are:

- Nykaa Cosmetics: Nykaa Cosmetics is a comprehensive makeup and beauty accessories brand present across lips, face, nails, eyes and beauty tools.

- Nykaa Naturals: Nykaa Naturals is a naturally derived ingredients focused brand for skincare products such as bath and body offerings, masks and haircare.

- Kay Beauty: Kay Beauty offers premium range beauty products across lips, eyes, face and nails categories.

- Dot & Key: Dot & Key offers premium skincare products across serums, toners, cleansers and face masks and has recently expanded into nutraceuticals.

- Twenty Dresses: The apparel product line includes western wear across dresses, jumpsuits, tops, pants skirts as well as footwear, bags, and accessories.

- Nykd by Nykaa: Nykd by Nykaa offers lingerie and includes bras, panties, sleepwear, shapewear and athleisure.

- Pipa Bella: Pipa Bella offers on-trend aesthetic jewelry such as earrings, necklaces, bracelets, rings and hair accessories.

- RSVP: RSVP offers a wide and premium collection of dresses, jumpsuits, tops and skirts as well as footwear and bags.

- Gajra Gang: Gajra Gang offers a wide and premium range of kurta sets, ethnic dresses, saree, tops and accessories.

Fulfilment and Operational Excellence

As of August 31, 2021, the Company served 26,727 pin codes, covering 89.2% of the serviceable pin codes across the country, and had 20 warehouses with a storage space of 665,371 sq. ft. Orders are monitored and tracked closely to ensure timely dispatch. 94.1% of Orders are delivered within five days in its beauty and personal care vertical and 72.0% of Orders are delivered within five days in its fashion vertical, for the quarter ended March 31, 2021.

The Company aims to invest further towards expansion of its physical store network to serve more consumers across the country. It also seeks to further leverage the synergies between the offline and online channels to create a seamless journey across touchpoints. As an extension of its Omnichannel capabilities, the Company commenced Nykaa PRO, a membership-based program for beauty professionals and makeup artists, providing them access to products, offers and classes, including, educational content. It is also conducting trials of SuperStore, an online channel with a separate mobile application for standalone local retailers in India to offer them select beauty and personal care products to offer to their consumers.

Resilient, Capital Efficient Business with a Combination Of Strong Growth And Profitability

The Company has built a scaled business with strong growth and profitability. Its revenue from operations grew 38.10% in the FY 2021 as compared to the FY 2020, despite the adverse impact of COVID-19 on its business. Profit for the year in FY 2021 was Rs. 61.95 Cr, as compared to a loss of Rs. 16.34 Cr. for FY 2020. Revenue from operations grew 183.05% for the three months ended June 30, 2021 as compared to the three months ended June 30, 2020. Profit for the three months ended June 30, 2021 was Rs. 3.52 Cr., as compared to a loss of Rs. 54.51 Cr. for the three months ended June 30, 2020.

Acquisition of Dot & Key

On September 28, 2021, the Company acquired 51% of the outstanding equity shares of Dot & Key Wellness Private Limited (“Dot & Key”) through the subscription and purchase of equity shares. Dot & Key is engaged in the business of manufacturing, marketing, branding and sale of skincare and personal care products, including serums, toners, cleansers, face masks and face creams. Dot & Key has also recently launched a few products in the nutraceuticals category.

With approx. 8% penetration, beauty and personal care segment in E-commerce category is one of the most underpenetrated segments compared to matured e-tailing categories providing huge scope for Nykaa. As part of its continuous efforts to offer a curated assortment of brands and products to its consumer base, the Company aims to continue to invest in entering into new brand relationships. It will also continue to nurture its existing brand relationships. The Company also aims to increase the product offerings in its current owned brand portfolio across its business verticals and add newer long-term focused brands. At the same time, it intends that its owned brands portfolio will continue to uphold the product quality and authenticity standards. The Company’s experience in acquisitions and joint ventures has provided it insights and growth opportunities, and it intends to continue to consider such transactions in India, particularly to supplement its market leading position, product offerings, channels and owned brands as well as expand in other lifestyle adjacencies.