5 Year Nifty Performance

by Rajat Sharma | May 04, 2016

The table below showcases 5 year Nifty performance.

Note: This is based on the current constituent companies of the Nifty.

Let me rearrange the above chart in descending order of returns. The results do tell a story:

Interesting Facts:

- 39 of the 50 Stocks have risen over the past 5 year period.

- During the same period the benchmark Nifty appreciated by 31.4%.

- Sectors that performed well – Private banking, IT, Automobiles and Pharmaceuticals.

- Under-performance – Oil & Gas (keep in mind that Cairn India was part of the Nifty until a few months back), Metals, Infrastructure and Power.

- The top 30 companies in the chart above have each grown at a CAGR of 10%+. Making stocks of each of these companies the best available investment avenues in hindsight (i.e. 5 years back).

- Based on previous track record of the Nifty: watch out for stocks in the infrastructure, oil & gas, metals and power space over the next 5 year period.

Here’s a table on the performance of Nifty stocks of April 2011. 14 companies marked in Grey got removed from the CNX Nifty basket over the past 5 years – i.e. between April 2011 to now. 12 of these 14 companies are in deep red, 1 got merged.

Visit here for sector wise weightage of the constituents of the Nifty 50

Share this post

Don’t forget to leave a comment

Don’t forget to leave a comment

4 Comments

Submit a Comment

Other Posts

Other Posts

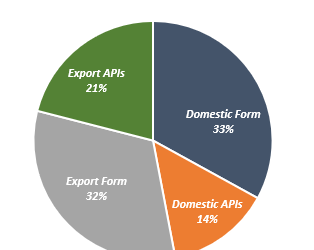

IPCA Laboratories Stock Analysis

IPCA Laboratories Limited (“IPCA” or the “Company”) is one of the world’s largest manufacturers and suppliers of over a dozen APIs. The Company’s product range includes pain management, cardiovascular medicines, anti-malarial, anti-emetic, antibiotic, analgesic, and...

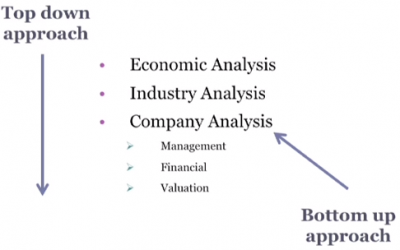

Understanding the stock market – a confluence of science, patience and luck

Back in 2014, at the peak of pessimism in stock markets there were hardly any takers for even the most marquee names in the stock market. Today’s Rs. 2300 share of Reliance was trading at 450. Infosys at 400 and HDFC Bank at 320 (both trading above Rs. 1000/ share...

G G Engineering Limited Stock Analysis

CMP: 62.50 View: Buy G G Engineering Limited (“GG” or the “Company”) is the most well-established players in Gensets & Reverse Vending Machine (RVM) industry in India. A reverse vending machine is a device that accepts used beverage containers and returns money to...

Free Investment Newsletter

Join us and connect with over 65,000 subscribers who benefit from our insights on the latest

in the world of stocks and personal finance.

Free Investment Newsletter

Join us and connect with over 65,000 subscribers who benefit from our insights on the latest

in the world of stocks and personal finance.

sir r u adjust the bonus split dv/right etc in the price? in this article

Yes.

Nice & informative Article…Awesome Rajat

Thanks Pradeep