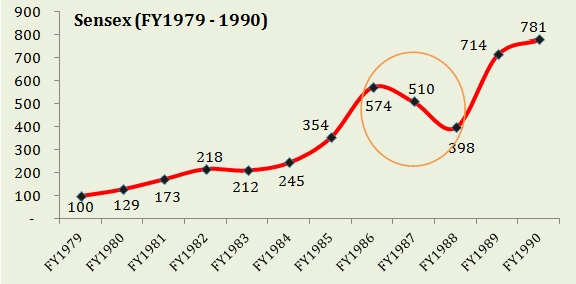

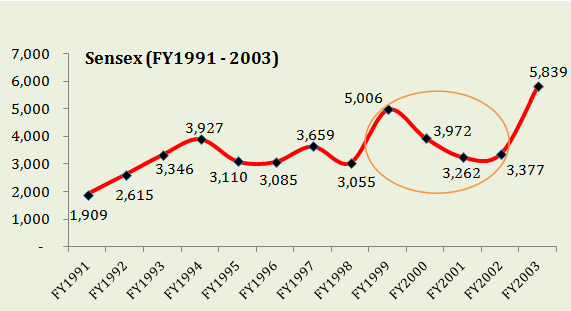

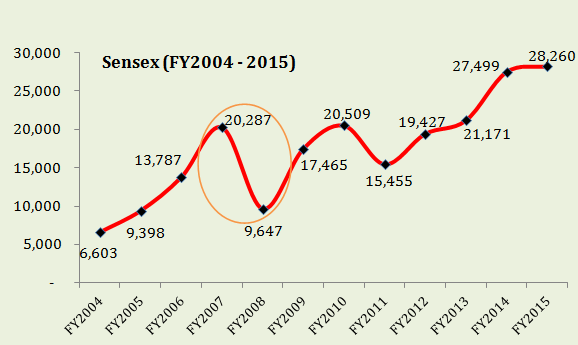

One year ago I did a detailed research on Sensex target for the year 2020 (full article here). In that research, I studied the growth of the Sensex over the last 24 years and analyzed where we could end up in the year 2020. At that time, the Price Earnings multiple for the Sensex as a whole was ~ 17.6 (as compared to 19.7 today- 8th April 2015). The average multiple for the past 10 years being ~19.35.

Based on different growth projections, I came up with two targets –

42,540 (moderate) | 54,286 (rational).

When the above research was done, the Sensex was trading between 21,000-22,000 points. Needless to say that it was an extremely dull time for the markets and for asset managers. Not many people were investing in stocks. It was also a better time to buy stocks with markets trading ~ 25% below their current levels.

In the above post I correctly predicted the beginning of a bull market. In this post I am predicting nothing. I will talk about a stock market crash in general. I do however predict that eventually a stock market crash will happen. At the same time, I maintain my 2020 target for the market.

What was common in all of the stock market crashes above?

In none of the years above asset managers, economists or market experts could predict the approaching stock market crash. On the contrary most were predicting higher targets for indices world over. While there were the occasional doomsday academics; their number was no greater than it is at any other time.

The ones who foretold the crash in the months or weeks immediately preceding it were admired for their insight and went on to sign book contracts. I guess they got their timing right!

From recession to revival to the next inflection point, an economic cycle follows the same path each time and yet there are no rules when it comes to economic forecasting. That said, even with such lack of clarity there are things which you should keep in mind at all times to protect yourself from a stock market crash.

[1] You never know when it hits you again

The phrase “double-dip recession” was mentioned 10.8 million times in 2010 and 2011 according to Google. It never came. There were virtually no mentions of “financial collapse” in 2006 and 2007. It did come.

I have been working in capital markets for over 10 years. In 2008 I told myself that ‘next time I will look out for a crash‘. My colleague at that time even figured a method:

Anytime the market crashes by over 35%, it will rise by at least 20% within a week from the session in which it breached the 35% mark’.

You can make any such rule but the next crash will be nothing like the last one. There will be absolutely no indication the next time either so don’t expect to receive a pre-recession announcement on CNBC.

[2] Its near its peak when your grocer starts buying stocks

I started my firm in the year 2011. Here is a look back at the biggest challenges I faced over the years and my prediction for the future:

2011-2012 – Pessimism

During these years my biggest challenge was to convince people about the benefits of investing in stocks. If ever I got someone’s attention for longer than a few minutes it was mostly because they wanted to learn what happened in 2008 and why people always lose money in stocks.

2013-2014 – Growing Skepticism

During these 2 years I became a full time finance writer, conducted lectures and met people most of whom wanted to discuss fixed deposits and safe mutual fund options.

2014-2015 – Optimism

For the last about 6-10 months I have noticed that people are far more willing to talk to me than they were ~ 3 years back. Equity investments seem to be making sense for many if not all. The line of questioning has changed to – stocks that will grow 15-20% on year on year basis.

My Prediction for beyond 2018 –Euphoria

Investors will start making money on anything they buy. That’s what happens in hyper-bull markets. You can buy anything and it will trade higher the next day. Once again it will be hard for me to get the attention of people for longer than a few minutes.

Just before the crash of 2008, everyone was buying stocks. The banker, the lawyer, the doctor . . . . even the grocer was investing in the market. Watch out for when this happens again!

[3] Those who look stupid at first are often the ones who succeed

You don’t have to catch the bottom, nor the peak. If you can manage to buy ‘anytime after‘ a substantial correction, you will be very rich. Over time stocks make new highs, I don’t think it should be difficult to start. What are you waiting for? Equally important is to sell when things stop making sense. No matter how much the market rallies after you sell, do not buy again.

In this regard, the hardest thing to do is to stick to your decisions. This becomes particularly true when at first your decision appears unintelligent. The longer you look stupid the tougher it is to stay firm with your decision. Some of my stock purchase decisions which I made in 2011-12 hardly delivered returns higher than a bank deposit for the initial years. In the last 4 years not only have I earned back my investment amount as dividends but the value of my principal has also appreciated.

I will tell you something which works 100% times – “If you manage to stay invested for long enough . . . . . you will make a lot of money. Period. There may be those who make more money than you and those who lose far greater, you however will do wonderfully.

Remember what the main prodigy tells the fastest of all his horses in the film Ben Hur – “You don’t have to win first, you have to win last.” If you have not seen Ben Hur, that’s what you should be doing this weekend.

[4] Keep calm and hold many assets

I could write a book on diversification. Not so much because I am risk averse but because I am not a big fan of it.

Unfortunately the nature of stock markets is such that you can never predict when things get out of hand (look at point 1 above). There will be 7-10 recessions over the next 50 years. Don’t act surprised when they come!

The only way you can really prepare yourself for a stock market crash is by keeping some of your money in other asset classes.Everybody has biases. There is nothing wrong with that. I have a bias against gold so any investment other than stocks goes into safer money market products.

I have always believed in the 100 minus your age rule (read here) when it comes to equity investments. Besides equities I like to own fixed income products.

Also Read: Best fixed income investment options in India.

The important thing is to hold on to other assets so you can fall back on them in times of need. Think of these assets as an insurance policy which you will use when all else fails.

Very well written..great insights

Thanks Navneet.

Sir, what is your view on gold over the next 3-6 months?

Pretty negative actually!

Nothing drastic really, at least for 3-6 months. I am long term negative on gold though.

great writing…..keep updating…all the best..

Thanks Pranav.

sir, i watched the interview on cnbc about the sensex and nifty over bought. but u didnt told the actual levels u r expecting from the market or bottom of the market. i have subscribed your blog and the level u suggested in your blog and the level u told on cnbc were different.

hope u should have told the actual levels, u would have became a hero of the market. sorry yaar, but it is true. love ur analysis and generated good alpha from it.thanks sir.:-)

Hi Abhishek – I think you mean Bloomberg not CNBC, can you share a link of where you saw this or was it a live show? Im not sure.