Before you make and execute your list of stocks to buy remember 3 things:

- Markets are expensive.

- Markets have been rising for 8 consecutive years (i.e. every year from 2016-2023).

- Have at least 35% of your portfolio in fixed-income instruments (these securities will still make you ~ 8% assured return p.a.).

Think about it, if markets rise 15% every year for the next 3 years and fall 15% in the 4th year, this is how your portfolio of equity and debt will look like at the end of 4th year:

| YEAR 1 | YEAR 2 | YEAR 3 | Year 4 | |

| EQUITY – 100 | 115 | 132 | 152 | 129 (negative return of 15%) |

| DEBT – 100 | 108 | 117 | 126 | 136 |

You can do the above math with a possible 15% correction in stock prices in any one of the next 4 years; you will notice that over a 4-year period, fixed income will outperform equity.

So, what should you do?

Avoid indices, stick to selecting stocks in the right sectors, and have a good amount of allocation in fixed income.

I could end this article right here, but there is more to comprehend.

Let me try to convince you that patterns and processes take a long time to play out and that planning for the next 1-2 or even 3 years is a pointless exercise. Below I will quote the performance of a few stocks which when recommended were amongst most derided by critics and investors alike.

[Case 1 – Lupin]

Lupin is trading @ 671.

My 18 month Target for this – 1428.

A full report to follow on the blog.— Rajat Sharma (@SanaSecurities) April 13, 2023

The stock is over 100% up from 671 to 1380 in 9 months. In reality, this did not happen for me in 9 months. I have been holding the stock since May 2022. That was when the company was hit by a slew of USFDA warning letters. In reality, nothing substantial had changed for the company (you can read a full report here – https://www.sanasecurities.com/is-lupin-a-good-stock-to-buy-at-current-price/). I was sure that this stock will bounce back in a big way since all that could go wrong had gone wrong by then. It was rock bottom to my mind. I was not sure when, but I was sure that good money will be made in this stock. The performance has exceeded my own expectations in the past 9 months. I have revised my target to 2100 on this stock. It may well have happened over the next 2-3 years. The point is that it had to happen.

[Case 2 – SJVN]

SJVN is a stock I’ve held for 8 years. In these 8 years (from November 2015 to now), I have earned a dividend of Rs. 17. I purchased it for Rs. 27. Here’s my original report on this. Pretty much everything played out as I anticipated, albeit with some delay – https://www.sanasecurities.com/sjvn-stock-analysis/

The most boring and ignored power stocks – SJVN and NHPC are trading at all-time highs and still pay a dividend yield of over 4.5%. I still feel they can more than double from here.

— Rajat Sharma (@SanaSecurities) November 10, 2022

From the date of my tweet above, the stock has gone up by almost 200% from Rs. 34 to Rs. 93. What I have enjoyed is not the recent rally but the dividends I received over the years. I have always believed that the best stocks to buy in any market are the ones which either pay a high dividend or (for tax reasons) retain a lot of profits as reserves. I am positive that the annual dividend will increase going forward and that in a few years, I would have recovered my initial purchase price of Rs. 27 in dividends alone.

[Case – 3 – ITC]

This remained a meme stock for close to 10 years, from 2013 to about 2023. I started buying this from about 2016. The reason was simple, the company’s PAT margins continued to grow between 25-30% year on year. The price remained stagnant primarily on account of continuous increase in excise duty on tobacco. However, as non-cigarette FMCG business matured and as the government slowed down on hiking excise rates on tobacco, ITC became a very attractive stock. At 226/ share, it offered a dividend yield of close to 5%. Yet it remained a meme stock. That was the best time to buy it.

ITC Target 380 by 31 December 2022.

— Rajat Sharma (@SanaSecurities) March 30, 2022

Given that this is an election year, the government will not be hiking excise duty on tobacco in this year’s budget. Hence, my revised target as below.

I am also upgrading my 1 year target for ITC to 748.

— Rajat Sharma (@SanaSecurities) July 27, 2023

[Case 4 – Hero Moto]

This is the best-performing stock I have recommended in 2023. I added this after Hero Moto announced its tie-up with Harley Davidson (not for the same reason though). It was then that I looked closely into this stock and the company’s financials. It had everything I like in a stock – (i) an ever-growing market of bourgeoning Indian middle class, (ii) excellent valuations, (iii) largest market share in the two-wheeler space; and (iv) a new tie-up with a world-renowned brand. It also had a dividend yield of 4.1%. I have remained mightly amused about why no one was buying it back then. I wrote multiple tweets and a full report on this, you can read it here in case of interest – https://www.sanasecurities.com/hero-motocorp-stock-analysis/

Two-wheeler stocks like Hero Moto and Bajaj are deeply undervalued. It is a good time to buy these as lumpsum.

— Rajat Sharma (@SanaSecurities) April 1, 2023

Undervalued stocks because of external circumstances –

– Hero Moto (Electric scooters/bikes)

– Lupin (USFDA observations)

– L&T Finance (Negative sentiment. That’s all!)— Rajat Sharma (@SanaSecurities) April 10, 2023

The stock that everyone will miss buying – is Hero Moto.

— Rajat Sharma (@SanaSecurities) April 25, 2023

[Case 5 – L&T]

Larsen & Toubro, the company accused of bad management will be the top wealth creator over the next 3 years. The question is, how many will have the conviction to buy an underperformer today?

— Rajat Sharma (@SanaSecurities) September 16, 2018

Disclaimer: I am negative on Larsen & Toubro at this price, and I don’t advise buying or even holding it at this price. For this reason, I will not get into my reasoning for buying this stock when I did. This however remained a core part of my portfolio over the past few years. Needless to say, I believe it is as good a stock/business as any.

[Case 6 – Infosys]

Infosys has remained my favorite stock over many years. The company is debt-free with a lot of cash which it can use for acquisitions and expansion in future (or distribute it amongst its shareholders). Irrespective of management commentary, Infosys has increased its annual revenue at 16%+ year on year for as many rolling years as you want to sample. Anyone who starts building a core portfolio in any market environment should add a few shares of Infosys at the very start. Period.

A year or so back, when ITC was trading ~ 230, I said I am investing in it for a target of 1000 in 10 years. I am investing in Infosys for a target of 10,000, and in Lupin for a target of 3000 in 10 years. Think at least 10 years ahead. It will be hard not to achieve your goals.

— Rajat Sharma (@SanaSecurities) May 29, 2023

The idea of buying stocks for me has always been about generating alpha, beating the market, earning a good dividend, and staying invested for many years. All you have to do is beat the market by 6%+ consistently for many years. The problem, however, is that market returns are not linear. There will be years in which you will underperform (and outperform the market by a mile). Give yourself at least 6 years to generate that 6% p.a. alpha. It is simple to achieve this if you buy and wait for the story to play out.

- Avoid get-rich-quick schemes

- But high-quality stocks but diversify your portfolio (most important)

- Have diversified sources of revenue (unless you are absolutely convinced about living on a salary for the rest of your life)

- Invest and build a portfolio with a view to not sell your investments for at least 10 years. Remember: If your idea is to invest and make money in 2024 – you will lose.

Recently, I sent out this portfolio offer to my subscribers. You can buy or write in to me if you have any questions before buying:

I have prepared a portfolio of 10 stocks across m-Caps:

- – 4 large-cap stocks

- – 3 mid-cap stocks

- – 3 small-cap stocks

Buy gradually over next 12 months.

Cost for this report is fixed at Rs. 34,450/- irrespective of investment amount.

How to Pay?

You can use this link – https://imjo.in/gg6Yh8 (For net banking)

For UPI / PAYTM, Use number – 9833905054

For NEFT transfer use below:

- A/c Holder name: Sana Research

- A/c No. 1338102000003513

- IFSC: IBKL0001338

- Current Account

Share a screenshot after making payment.

For any questions, write in to me at – rajat@sanasecurities.com

Please leave a comment.

Note: I will send you the above report upon subscribing. I will be happy to get on a call to discuss:

- Stocks of interest to me at this point (including my small case stocks)

- Your portfolio allocation and share my views on any changes you should make

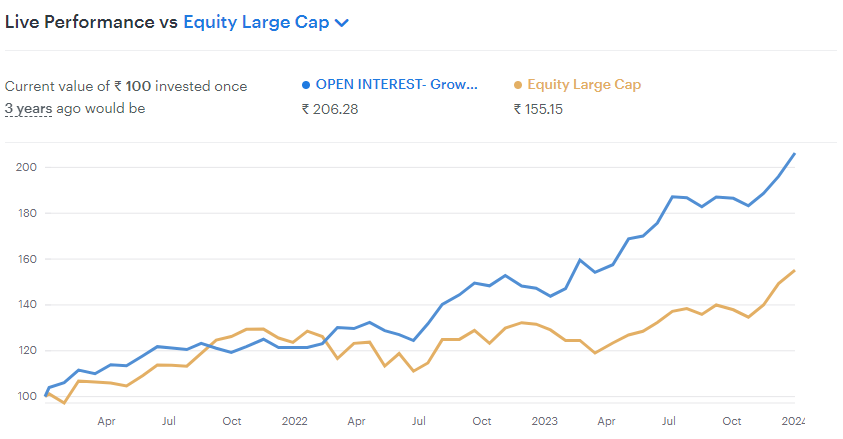

My past Smallcase performance since launch on 23rd October 2020: